In today’s fast-paced digital age, credit cards have become an indispensable part of our daily lives. They offer unparalleled convenience, enabling quick purchases both online and offline, as well as seamless access to global marketplaces. However, with this convenience comes the growing responsibility to safeguard sensitive credit card information. As technology advances, so do the tactics of fraudsters who exploit vulnerabilities to commit identity theft and financial fraud. The risks of stolen credit card data—whether through phishing scams, skimming devices, or data breaches—are more prevalent than ever. Protecting your credit card is no longer optional; it’s a necessity for maintaining financial security and peace of mind.

Common Threats to Credit Card Security:

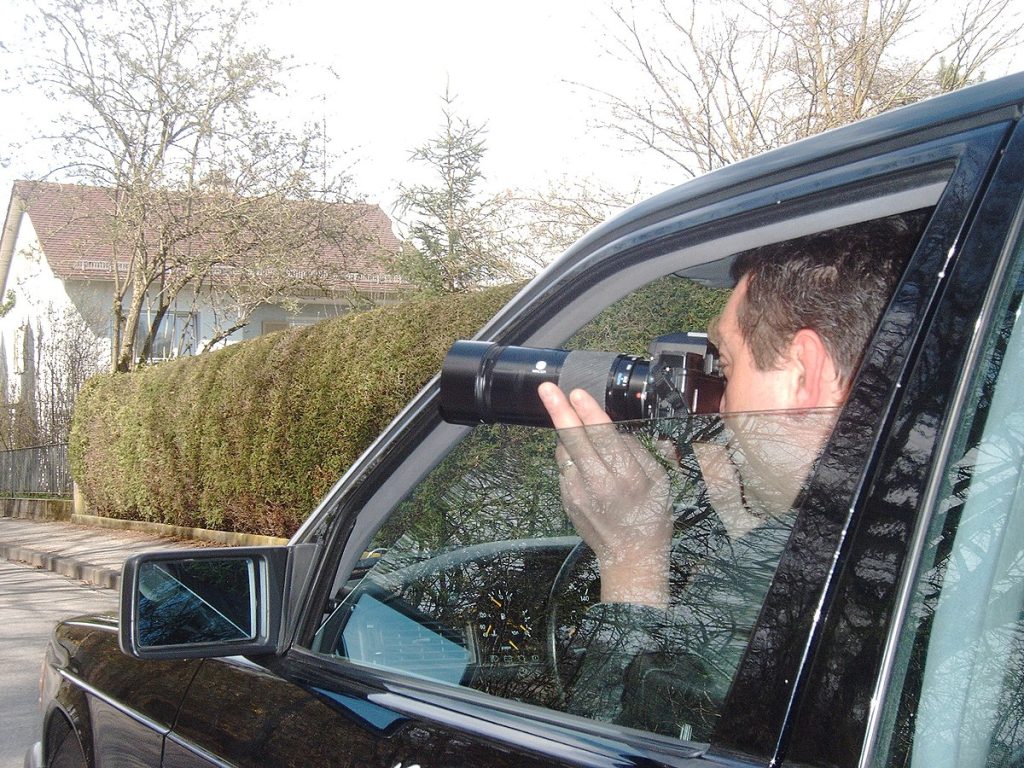

Credit card security is constantly at risk from various threats, each evolving to exploit vulnerabilities in our everyday transactions. One of the most common dangers is skimming and card theft, which can occur in both physical and digital environments. A stolen card in the wrong hands can lead to unauthorized purchases, while skimming devices discreetly placed on ATMs or point-of-sale systems extract card information without the owner’s knowledge.

Another major threat is phishing scams, where fraudsters use fake emails, websites, or text messages to trick individuals into revealing sensitive card details. These scams often mimic trusted institutions, creating a false sense of security and leading unsuspecting victims to provide their private information.

Data breaches are another growing concern in today’s interconnected world. Hackers target businesses and websites that store credit card data, compromising millions of accounts in a single attack. Even reputable companies are not immune, leaving customers vulnerable to fraud despite their best precautions.

Finally, online shopping fraud poses significant risks, especially with the increasing popularity of e-commerce. Unsuspecting shoppers may fall prey to fake or unsecured websites that capture card details during the checkout process. Such platforms often offer enticing deals to lure customers, only to misuse their financial information.

Understanding these threats is the first step toward mitigating the risks and keeping your credit card safe.

Tips to Safeguard Your Credit Card

Keeping your credit card secure requires a proactive approach that addresses both physical and digital risks. First and foremost, prioritize physical protection. Always store your card in a safe place and never leave it unattended in public. When making in-person payments, monitor your card closely and ensure it isn’t taken out of sight by the cashier or attendant.

For secure online transactions, shop only on trusted websites that use HTTPS encryption, easily identified by the padlock icon in the address bar. Avoid conducting financial transactions over public Wi-Fi networks, as these can be vulnerable to hackers intercepting your information. Instead, rely on private, secure networks or use a VPN for added protection.

Enabling security features on your credit card can provide an extra layer of defense. Set up two-factor authentication for online transactions, which requires an additional code sent to your phone or email for verification. Additionally, opt for transaction alerts via SMS or email to receive real-time updates on card activity, helping you quickly identify unauthorized use.

Regular monitoring of your credit card statements is essential. Review your transactions frequently and compare them with receipts to ensure accuracy. If you notice any unfamiliar charges, report them to your card issuer immediately to minimize potential losses.

Lastly, consider using virtual cards or digital wallets for online purchases. Virtual cards generate temporary card numbers for single-use transactions, while digital wallets like Apple Pay or Google Pay use encryption and tokenization to protect your card details during payments. These technologies reduce the risk of exposing your actual card information, especially in the digital space.

By adopting these habits and tools, you can significantly enhance the security of your credit card and enjoy peace of mind while making transactions.

What to Do If Your Credit Card Is Compromised:

If your credit card is compromised, acting swiftly can minimize the damage and help restore your financial security. The first and most critical step is to contact your bank or card issuer immediately. Inform them of the situation and request that your card be blocked to prevent further unauthorized transactions. Most banks can issue a replacement card quickly, ensuring minimal disruption to your financial activities. Additionally, report the fraud to local authorities or consumer protection agencies, such as the Federal Trade Commission (FTC) in the United States, to document the incident officially.

After taking immediate action, it’s essential to remain vigilant for signs of ongoing fraud. Regularly checking your credit reports can help you spot unusual activity, such as unauthorized accounts or inquiries made in your name. You are entitled to a free credit report annually from each major credit bureau in many countries, allowing you to monitor your financial information consistently.

For added security, consider using credit monitoring services. These services provide real-time alerts for suspicious activity related to your credit, enabling you to respond quickly to potential threats. Some financial institutions also offer similar features as part of their customer benefits, making it easier to stay on top of your credit health.

By taking these proactive measures, you can mitigate the impact of credit card fraud and ensure your financial safety moving forward.

The Role of Financial Institutions:

Financial institutions play a crucial role in safeguarding your credit card information and protecting you from fraud. Banks and card issuers employ advanced fraud detection tools and AI monitoring systems to identify and block suspicious activities in real time. These systems analyze transaction patterns, flag anomalies, and alert you to unusual behavior, ensuring potential threats are addressed promptly.

Another vital layer of protection comes from liability coverage for unauthorized transactions. Most card issuers have policies in place that limit or eliminate your financial responsibility for fraudulent charges, provided you report them in a timely manner. This ensures that even if your card information is compromised, your finances remain largely unaffected.

As a cardholder, you are also entitled to certain rights and protections under consumer laws and your card agreement. These rights may include dispute resolution for unauthorized charges, the ability to freeze your card temporarily, and access to customer support for resolving issues quickly. Familiarizing yourself with these rights can empower you to take action effectively in case of a security breach.

By combining technological advancements, robust policies, and consumer protections, financial institutions create a secure environment for credit card transactions, giving you peace of mind in managing your finances.

Emerging Technologies in Credit Card Security:

Emerging technologies are revolutionizing credit card security, offering enhanced protection against fraud and unauthorized access. Two significant advancements in this space are tokenization and biometric authentication, which have redefined how transactions are processed.

Tokenization replaces sensitive card details, such as the card number and CVV, with a unique, randomly generated token during transactions. This token is meaningless outside its specific context, ensuring that even if intercepted, it cannot be used by fraudsters. Tokenization is especially effective in online transactions and digital wallets, adding a critical layer of security by reducing the exposure of actual card data.

Biometric authentication, such as fingerprint scanning, facial recognition, or voice recognition, adds another robust safeguard. By tying access to your unique biological characteristics, it becomes nearly impossible for unauthorized users to gain access to your card or payment platforms. These technologies are increasingly integrated into mobile devices and digital wallets, offering convenience without compromising security.

Another game-changing innovation is contactless payment technology, which allows users to make payments by simply tapping their card or smartphone on a compatible terminal. This method leverages Near Field Communication (NFC) or Radio Frequency Identification (RFID) technology. While quick and convenient, contactless payments are also secure, as they use encrypted communication and dynamic transaction codes that change with every purchase, rendering the data useless to potential attackers.

These advancements in credit card security not only provide a safer transaction environment but also enhance user experience by combining convenience with cutting-edge protection. As these technologies become more widespread, they promise to significantly reduce the risks of fraud and unauthorized access in the financial ecosystem.

Conclusion:

Credit card fraud is a constant threat, making it crucial to take proactive steps to protect your financial information. By understanding the risks, monitoring transactions, enabling security features, and using emerging technologies, you can minimize the chances of fraud and ensure peace of mind. Staying vigilant and adopting consistent security practices is key to safeguarding your financial well-being. Feel free to share your thoughts or experiences in the comments, and don’t forget to share this blog to help others keep their finances secure.