In today’s dynamic and interconnected business landscape, the threat of fraud has become increasingly prevalent. As organizations strive to protect their assets and maintain financial integrity, the role of fraud examination has never been more critical. This blog aims to shed light on the intricacies of fraud examination, offering insights into its importance, methodologies, and the evolving landscape of fraudulent activities.

The Importance of Fraud Examination:

Fraud poses a significant risk to businesses, leading to financial losses, reputational damage, and legal consequences. Examination plays a pivotal role in identifying, preventing, and addressing fraudulent activities. It encompasses a range of techniques and methodologies aimed at uncovering deceptive practices, providing organizations with the tools they need to safeguard their assets and maintain trust.

The Process

Detection:

The examination often begins with the detection phase, where red flags and anomalies are identified. This involves the analysis of financial statements, transaction records, and other relevant data to spot irregularities that may indicate fraudulent activities.

Investigation:

Once potential fraud is detected, a detailed investigation is initiated. This phase involves collecting evidence, conducting interviews, and employing forensic accounting techniques to delve deeper into the suspected fraudulent activities. Investigators must navigate legal and ethical considerations while ensuring the integrity of the process.

Prevention and Remediation:

Fraud examination is not only reactive but also proactive. Organizations can implement preventive measures based on the findings of investigations to fortify their defenses against future fraudulent activities. Additionally, remediation strategies are employed to recover losses and mitigate the impact of fraud.

Methodologies and Techniques

Forensic Accounting:

One of the cornerstones of fraud examination is forensic accounting. This involves the application of accounting principles to investigate financial discrepancies and uncover evidence of fraudulent activities. Forensic accountants play a crucial role in unraveling complex financial schemes.

Data Analytics:

The increasing digitization of business processes has given rise to the use of data analytics in fraud examination. Analyzing large datasets can reveal patterns and anomalies that may not be apparent through traditional methods, enhancing the efficiency and effectiveness of fraud detection.

Interview Techniques:

Skilled interviewers are essential in the fraud examination process. Conducting interviews with individuals involved in or affected by the fraudulent activities can yield valuable information and help build a comprehensive understanding of the situation.

Evolving Landscape of Fraud:

As technology advances, so do the methods employed by fraudsters. Organizations must stay vigilant and adapt their fraud examination strategies to address emerging threats such as cyber fraud, identity theft, and sophisticated financial schemes. Continuous education and awareness are crucial in staying one step ahead of those seeking to exploit vulnerabilities.

Understanding fraud examination is paramount for organizations aiming to protect their assets, reputation, and stakeholders. By adopting a proactive approach, leveraging advanced methodologies, and staying abreast of the evolving landscape of fraud, businesses can mitigate risks and foster a culture of transparency and accountability. Embracing the principles of fraud examination is not just a safeguard; it is an essential component of a resilient and thriving organization.

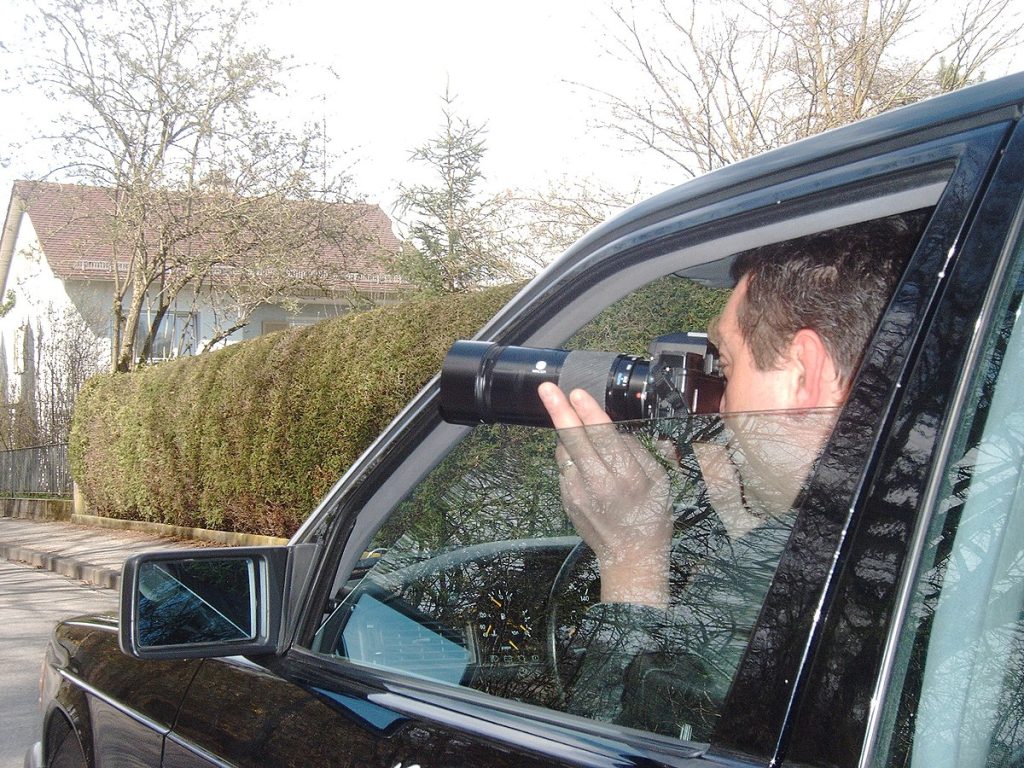

If you’re a victim of fraud, you need a Private Investigator, Private Eyes Inc. Can Help!

Call Now for a Free Confidential Consultation 866-PRI-EYES (774-3937)